Airfreight capacity vital for horticultural exports

Export airfreight capacity for the Australian horticulture sector has undergone severe disruption under the spread of COVID-19. A recent report from Hort Innovation projects up to 83,000t (including avocados) will be looking for a way to reach markets overseas.

In delivering the final report for Understanding export supply chain logistics, matching production and export aspirations with airfreight capacity (ST19034), the Centre for International Economics found the current airfreight availability might not be sufficient to meet market opportunities.

The report, which you can find in the BPR Library (or search for ST19034), has found the export market impacts of COVID-19 include:

- reduced airfreight capacity across all port locations

- limited to no passenger planes exiting the country

- high cost of airfreight — at times up to 8 times pre-COVID levels

- reduced ability to communicate on the ground with in-market partners and uncertain social, political and economic conditions.

In total, it is projected that around 83,000 tonnes of airfreight capacity will be required for horticulture, with fruit accounting for about 72.9% of that total.

The report found the open ports of Singapore and Hong Kong will have the highest airfreight requirements followed by China, United Arab Emirates and Malaysia. (You can read a pre COVID-19 assessment for Singapore, Hong Kong and Malaysia, with regard to avocados here in the BPR.)

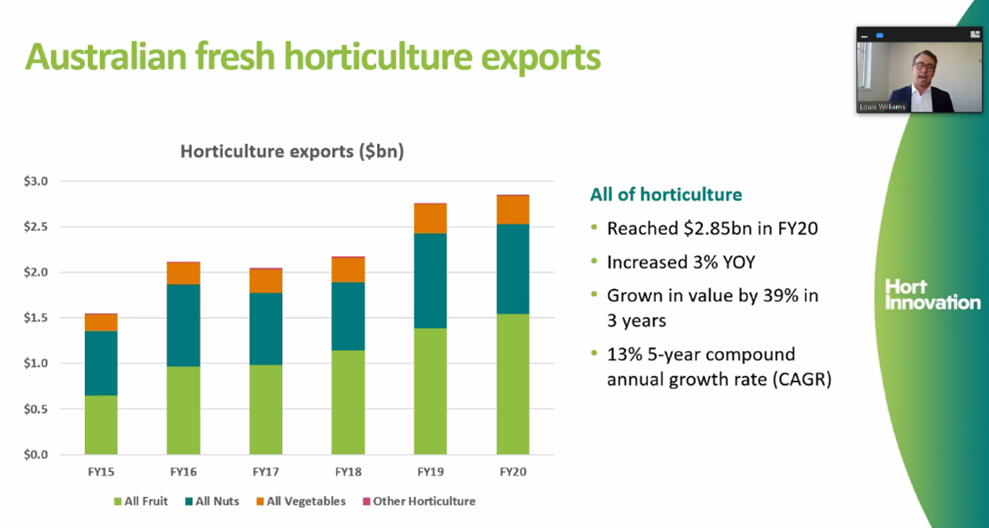

Australia’s fresh horticulture exports were strong in the 2019/20 financial year, according to Hort Innovation. Information provided in Thursday’s Insights webinar, showed the value of exports reach $2.85 billion in 2019/20.

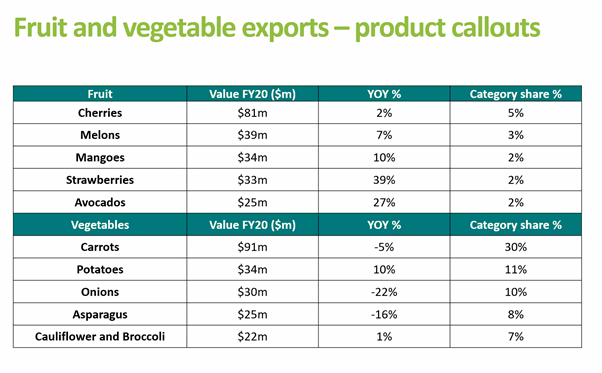

This was a growth of 3% year-on-year, and a growth in value of 39% in three years. The increase in 2019/20 was driven by the fruit category, which grew 11% year-on-year. This included a contribution of $25 million from avocado exports.

The ST19034 report found that restricted access to airfreight and increased airfreight charges through 2020/21 had the potential to impact on horticultural export volumes and divert them to the domestic market, with potential impacts on domestic prices. This may not be reflective of the expected situation for avocados, given a lower than expected harvest is now forecast for the summer months. (Read more in this new article.)

However, the report does make it clear that 100% of our current avocado exports are airfreighted, and despite the Australian Government’s International Freight Assistance Mechanism (IFAM), capacity for airfreight remains low, as passenger flights have been severely curtailed by COVID-19.

International travel still subdued

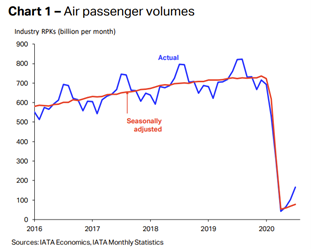

The latest International Air Transport Association report into passenger flight volumes (click here for these reports) makes it clear there has been limited recovery in the passenger market, with passenger-kilometres contracting 79.8% year-on-year in July 2020. There was a slight rise in demand but this was driven by domestic travel (mainly in Russia and China), not international travel.

Record Australian avocado exports in 2019/20

This is a disappointing situation for the Australian avocado industry, coming as it is off a record export level in 2019/20 of 4,052 tonnes. This was a 26.8% increase, and achieved despite the impact of the global pandemic in the first half of 2020. (You can find the latest Australian avocado exports and imports report here. If you want to see previous editions, these are in the BPR Library.)

Trade to Hong Kong more than doubled while Malaysia and Singapore, the key markets both recorded higher volumes in 2019/20. Middle East markets increased three-fold off a low base, and trade to Japan lifted 10-fold from three (3) to 40 tonnes.

Avocado exports from Western Australia increased 73% to 1,370 tonnes and accounted for 34% of Australian exports. Queensland, the leading export state decreased 5% to 1,560 tonnes and 38.5% share, and New South Wales increased 6%. Victoria increased by more than 200% to 493 tonnes.

Want regular export news?

Sign up for Export Coordinator Joy Tang’s regular email updates on avocado export related news and grants. Email your contact details to export@avocado.org.au to be subscribed. (Note, you must be a participant in the Australian avocado industry to subscribe.)

Date Published: 04/09/2020