The Avo Insider and its contents are a member-only service of Avocados Australia. You will not see these articles in the media or our other publications.

Since my last article, we have completed the ten trial shipments to India, received approval by Japan Ministry of Agriculture, Forestry and Fisheries (MAFF) for our accredited property list to begin exports from WA, completed Thailand accreditation for Western Australia growers and packers, discussed progress with Department of Agriculture, Fisheries and Forestry (DAFF) for New Zealand market access improvement specifically regarding avocado sunblotch viroid (ASBVd), begun building some frameworks around market access improvement for Japan, taken important steps toward progressing market access to Vietnam and China, and collaborated with project authorities to make critical and positive strides toward the launch of the forthcoming $100M Fruit Fly R&D investment project, AM22000.

India

The India trial shipment taskforce made up of members from DAFF, Austrade, Avocados Australia (AAL), and industry, successfully orchestrated the execution of shipments to Delhi and Mumbai under the Indian draft protocol. The tenth and final trial shipment arrived in India on 5 July, and we are excited to announce the successful completion of the trial shipment process. Again, a big thank you to all the growers and packers that submitted an EOI to participate in the trial shipments, and to trial partners; Costa, Simpson Farms, Don Fort Packing, The Avolution Group, and Sunny Spot Farms, for their diligence, patience, and investment, to achieving a great outcome for industry.

AAL and DAFF are working toward an indicative timeline to try and have growers and packers registered and accredited late August-early September, to continue the supply chain into India. All involved are working feverishly to ensure there is as little disruption to the supply chain into India, particularly given the trial shipment avocados are already being successfully sold through retail to Indian consumers.

The Minister for DAFF, the Hon. Murray Watt, invited AAL CEO, John Tyas, to attend a department outbound trade delegation visit to India in early July where John had the opportunity over several days to network with Minster Watt to progress the launch plans of Australian avocados into India, but also spend time discussing with Minister Watt other important key steps the avocado industry needs to take to drive access into our priority markets such as Vietnam and China, and market improvement pathways for Japan and New Zealand.

Japan

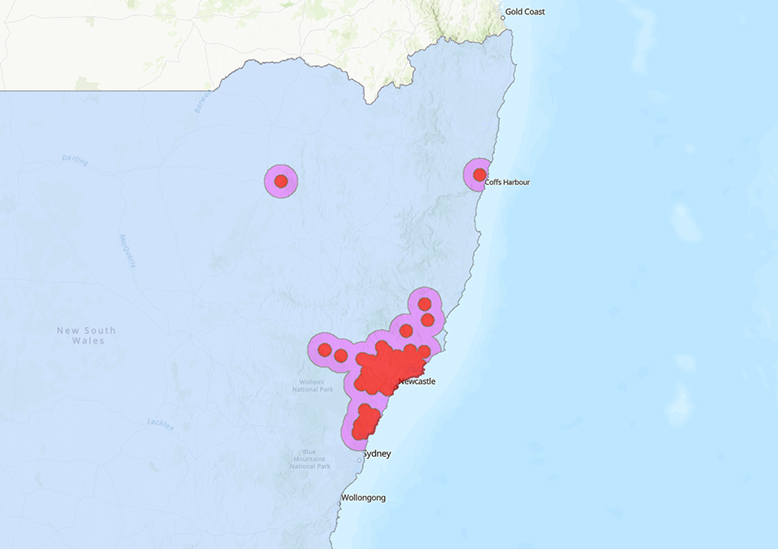

April through June, the WA industry underwent their annual Japan registration and audit/accreditation process. All applicants passed with flying colours, and subsequently the accredited list has been approved by MAFF. We witnessed the growth of the applicant pool with 7 new growers and 1 new packer bringing the total accredited pool to 22 growers and 5 packers. Exports began early July with demand looking greater than in previous seasons.

Gaining market access improvement to Japan for the broader Australian avocado industry is a key performance indicator for AAL and aligns with the market improvement plan of DAFF. Japan’s MAFF have provided technical feedback to DAFF on the barriers we need to address and overcome to ensure our fruit is pest free. AAL are working with researchers, namely research partners of the Fruit Fly investment project, AM22000, to curate a research plan, and data package, sufficient to meet technical barriers.

Thailand

The Industry Advice Notice (IAN) for registrations for Thailand opened at the same time as Japan. WA growers and packers were able to register in sync with Japan registrations. Late June, Thailand Department of Agriculture (DOA) rubber stamped the official gazetted protocol. DAFF will undertake Thailand audits and accreditation in preparation for an accreditation visit by the Thailand DOA late August. Thailand DOA will require industry to complete one verification shipment as a the requirement of the protocol. This shipment can be shipped immediately after Thailand’s verification visit, and it could be expected that WA could have access to export early October, and as early as mid-September if an air freight shipment is allowed for the verification.

New Zealand

ASBVd is a quarantine pest for New Zealand. New Zealand currently requires Australian avocados to be sourced from orchards that have been planted using approved stock known to be free from ASBVd. Under these conditions a grower must provide documentary evidence for registration with an official tree certification scheme such as ANVAS, with reference to indexed and non-indexed blocks. While this approval of orchards based on ASBVd-free planting material is an effective means of demonstrating freedom from ASBVd, these conditions mean that if records such as the identification numbers for the planting material are not available, or trees have been replaced without appropriate records, the orchard may not be approved for export.

A new statistical survey protocol has recently been developed for demonstrating freedom from ASBVd at the production site level. The protocol has been published in a peer-reviewed journal (Bonnéry et al. 2023) and implemented in a software app that allows users to optimise sampling strategies for testing to demonstrate freedom from ASBVd.

Australia is proposing to include orchard surveys based on this protocol as an alternative option to demonstrate freedom from ASBVd to the import conditions for fresh Australian avocado fruit to New Zealand. This option would enable avocado orchards to be retrospectively certified as pest free places of production based on surveying, which would allow pest freedom certification where historical records of the ASBVd-free planting material are not available.

DAFF made this submission to the New Zealand Ministry for Primary Industries on 25 May and are awaiting feedback.

Vietnam

DAFF are currently at the tail end of negotiating access for blueberries and plums to Vietnam. It is expected these negotiations will be finalised in 2024. Avocados are sitting within the Industry Market Access Assessment Panel (IMAAP) negotiation pool, alongside several other commodities, as next in line for potential negotiation. Work is ongoing to best prepare avocados in the event we are chosen as the next commodity within the pool. I will make a visit to Hanoi, Vietnam, week 7 August, to meet with Vietnam Ag Counsellor, Tony Harman, and Commissioner for Trade and Investment, Chris Morley. Meetings with importers, the Fruit and Vegetable Association and retailers will also take place. Intelligence gathering will assist in the ongoing development and execution of our Vietnam Market Access Strategy.

China

There has been much discussion broadly through Commonwealth Ministers, including our Prime Minister, the Hon. Anthony Albanese, on the thawing and rebuilding of bilateral trade relations between China and Australia. We have witnessed the export re-ignition of horticultural and agricultural commodities into China, and healthy rhetoric from senior Chinese diplomats. China, as we know, remains a burgeoning market for all goods and services from all corners of the globe, and in particular, Australian products. Financial prosperity remains trending upwards across their middle class and data indicating the appetite for avocado reflects increasing demand.

Similarly, to Vietnam, DAFF continue to push the negotiations with General Admission of Customs China (GACC) for apples and blueberries. Avocados sit alongside other commodities in the IMAAP pool for an opportunity to be next in line for negotiation. I will embark on an exploratory visit to Beijing and Shanghai immediately following Vietnam, to meet with Chinese avocado importers, our China Agriculture Counsellor, Leah Cuttriss, and Chinese customs and quarantine authorities, to begin understanding the biosecurity barriers we may face in any likelihood of future technical market access negotiations. A key meeting will take place in Beijing with China’s leading avocado researchers from Nanning, to help understand where the opportunities lay for forming a China-Australia Avocado Alliance that will work to advance our market access credentials. It is planned for a broader industry trade delegation visit to China in September to participate in the China Fruit & Vegetable Conference (Guangzhou, September 21-23). This trip will also help to drive our market access agenda more broadly, expand and develop our networks across the Chinese avocado industry, importer community, Australian-China Chamber of Commerce, retailers, and other key influential constituents that help raise the awareness of Aussie Avocados in China which can help drive market access prioritisation.

AM22000

AM22000 is the new market access fruit fly R&D investment project. One of the fundamental goals of this investment is to derive robust data packages to assist in the negotiations for market access and/or market improvement. The project has an 8-year tenure and will afford circa $100M of investment to drive substantial and tangible R&D outcomes. AAL has been working closely with Hort Innovation and the Queensland Department of Agriculture and Fisheries project management team to best prepare broader department and industry consultation. It is expected the project will begin in the third quarter of 2023. The project will launch at EKKA, Brisbane, August 14, in which AAL will be participating.

This article was produced for the July 2023 edition of the Avo Insider.