About the Australian avocado industry label

Avocados Australia has managed the Avocados Australia’s Industry Label (Kangaroo Label) for use on Australian grown avocados since 2011. The industry label was established with industry sustainability at the core, by enabling a connection between the Australian avocado industry and consumers, for mutual benefits.

The Avocados Australia’s Industry Label, managed by Avocados Australia, provides industry members with the opportunity to leverage the $4m industry funded marketing campaign to drive the sales of their avocados through a united and recognisable brand throughout the consumer path to purchase.

A Case for Change

Since 2011, the core design of the industry label has remained unchanged. However, notably there have been developments in consumer demands, category maturity and retailer requirements regarding labelling such as the introduction of the GS1 Databars to which Avocado’s Australia has had to adapt the label.

Ten years on, there was a need to re-evaluate the industry label to ensure it continues to offer the maximum value to its users within industry as we navigate into a period of increased domestic production and competition with imported product.

Research Objectives

The objectives of the research were to:

- Identify design elements which are effective in:

- Identifying Australian grown avocados

- Aligning to the branding of the levy-funded marketing campaign

- Driving sales for users of the avocado industry label

- Understand consumer attitudes towards the industry label design against proprietary designs

- Understand the total value of an industry label

Methodology

An electronic survey was distributed to 500 main grocery buyers aged between 18-65 years old living in Australian major capital cities. Participants were segmented into the six consumer segments identified in the industry consumer segmentation study conducted in 2017:

- Everyday Routine Consumer

- Gourmet Creative Consumer

- Selective Diet Consumer

- Occasional Treat Consumer

- Unfamiliar Unsure Consumer

- Non-Consumer

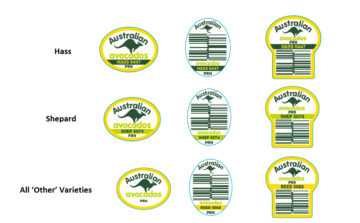

No branding was used on the distributed survey and responses were anonymous to try and reduce potential survey bias. Participants were asked a series of questions consisting of multiple choice, short answer and long answer questions. Labels included in the survey are shown in Figure 1 in randomised order:

Figure 1 – Labels included in the survey

Figure 1 – Labels included in the survey

The Results

How important is purchasing Australian grown avocados?

72% of participants stated when purchasing avocados, it is either very important (34.11%) or extremely important (37.81%) that their avocados are grown in Australia. Further to this, consumers were willing to pay a premium for Australian avocados over imported fruit and 91.87% of consumers indicated they would be more inclined to purchase Australian over imported avocados if they could easily identify Australian avocados in-store.

How identifiable are Australian Avocados in store?

55% of participants indicated they find it difficult to identify Australian avocados in store. They stated that this was because “(the country of origin) is not usually clear unless the brand states it in their label”, “because the labels aren’t always clear or don’t state they are grown in Australia” and because “the labels are too small to read”. Therefore it is no surprise that 55.44% of participants were unsure whether they had purchased an imported avocado in the past 12 months.

Consumers want to support Australian avocado growers but they find it difficult to identify Australian avocados on shelf and can you blame them? See Figure 2.

Figure 2 – The range of different labels consumers see in retail stores.

How does Avocados Australia’s Industry Label stack up?

Participants were initially presented 10 different avocado label designs and asked to select which 3 avocado labels they would purchase based on these labels? This question was intentionally positioned as the first question of the survey to reduce survey bias which may skew results if asked towards the end of the survey when participants had been exposed to stimulus in other questions.

Without prompt, over 50% of consumers indicated a purchasing preference towards Avocados Australia’s Industry Label. When consumers were asked about the reasoning behind their selection, it was evident that there was a preference for “Australian grown” avocados with a number of consumers associating this with “quality” and “trust”. Second to this, it was evident that many consumers had based their decision on label designs that were clear and appealing to them.

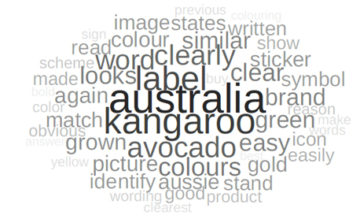

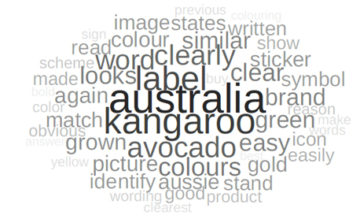

Figure 3 – A word cloud diagram showing the words used by respondents to explain their label choices.

Figure 3 – A word cloud diagram showing the words used by respondents to explain their label choices.

Identifying Australian grown Avocados

90.2% of participants identified Avocados Australia’s Industry Label (see Figure 4) as the avocado label which was easiest for them to identify as an Australian grown avocado. Many participants stated this was due to a combination of the prominent wording of “Australian” and the “Kangaroo” imagery. Surprisingly, participants rated the label of New Zealand origin as being more identifiable than most of the labels with Australian origins. When we analysed why participants identified the New Zealand label as “Australian”, participants referenced the “colours” and because they were familiar with this brand in-store.

Figure 4 – Label chosen by participants.

Figure 4 – Label chosen by participants.

Alignment to the levy-funded marketing program

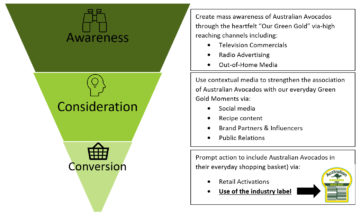

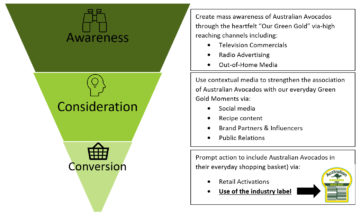

The 3-year marketing strategy for Australian Avocados is to convert infrequent buyers into integral buyers. This will be achieved through;

- Creating mass awareness of Australian Avocados through the heartfelt “Our Green Gold” via high-reaching channels.

- Use of contextual media to strengthen the association of Australian Avocados with our everyday Green Gold moments

- Prompting action to include Australian Avocados in their everyday shopping basket

Figure 5 – A word cloud depicting what respondents were looking for on the avocado labels at retail.

Figure 5 – A word cloud depicting what respondents were looking for on the avocado labels at retail.

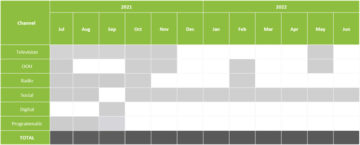

$4.02m of grower levies were invested into the Australian Avocado marketing program in FY 20/21 (Hort Innovation 2021). This investment is expected to continue to grow in coming years as production across the industry increases and enables marketing across a diverse range of channels such as;

- Television

- Radio

- Out of Home Media

- Social Media

- Digital Media

- Public Relations

- Retail Activations

The “Our Green Gold” campaign which launched in May 2021 aims to build brand love, help drive preference of Australian Avocados, grow unaided brand recall and drive consideration, which will contribute to increasing frequency of purchase. The campaign to date has won a number of awards and been crowned a winner of the Parent’s Voice Fame Awards, the Best use of Multi-Format campaign from the Outdoor Media Association and more notably, the fan-favourite ad during the Tokyo 2020 Olympics winning free placement in Seven’s biggest sporting and cultural moments of the next nine months, worth $1 million. Activity will continue into FY22 across a range of channels aligned with the 3-year strategy.

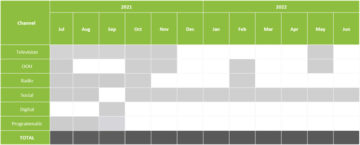

Figure 6 – Australian Avocado Marketing Indicative Block plan FY22 (subject to changes).

The Australian marketing levy forms the foundations for a strong and successful industry and has done so since its introduction in 1991. There is strength in working collectively as an industry to drive demand through offering consistency in supply, quality and branding all year round. There are unparalleled benefits in utilising Avocados Australia’s Industry Label to leverage the $4m+ marketing campaign which has a heightened focus on creating an increased awareness and consideration for Australian Avocados. This would ensure consistent touchpoints throughout the consumer path to purchase and most importantly at point of sale where consumers are making split-second purchasing decisions.

Figure 7 – Consumer path to purchase.

Figure 7 – Consumer path to purchase.

To evaluate whether the proposed Avocados Australia’s Industry Label aligns to the levy-funded marketing campaign, participants were shown images of Australian Avocados branding and marketing collateral (see Figure 8) and asked to select the label which aligned to the branding out of a selection of 9 avocado labels.

Figure 8 – Images of Australian Avocados branding and marketing collateral.

Figure 8 – Images of Australian Avocados branding and marketing collateral.

Of the nine different labels, including the eight proprietary labels and one Avocados Australia Industry Label, 81% of participants identified the Avocados Australia Industry Label (Figure 9) as the label that most clearly aligns to the branding shown. Participants explained this was due to the consistent wording, font and colours in the label, matching the branding and marketing collateral shown. Interestingly, 12% of participants selected those labels with green and gold colouring, despite one of these labels stating it is from New Zealand.

Figure 9 – Avocados Australia Industry Label.

Figure 9 – Avocados Australia Industry Label.

Testing Design Variations

The label (see Figure 10) with the yellow edge rated the strongest with consumers with 83.33% of participants preferring this label over the existing design (16.67%). Consumers were asked why they had made this selection and it was no surprise that the prominent wording of “Australian”, the kangaroo symbol and the green and yellow colour pallet all appealed strongly to consumers.

Figure 10 – On the left, an avocado with the Avocados Australia Industry Label. On the right, a word cloud depicting the words that respondents used to describe the label.

Figure 10 – On the left, an avocado with the Avocados Australia Industry Label. On the right, a word cloud depicting the words that respondents used to describe the label.

QR Codes as an option

We also tested the option to incorporate QR codes on avocado labels and at point of sale to link consumers to recipes, nutritional information, hacks and storage tips. Consumers indicated they would prefer to scan this information from posters at point of sale rather than on an avocado label, highlighting potential opportunities to provide inspiration at point of sale at the touch of a button via the use of QR codes. For those packhouses and marketer particularly wanting to integrate a QR code for marketing purposes, please reach out to discuss with Avocados Australia.

But I don’t want my reputation damaged by other packers’ inferior quality!

We are aware that some growers have concerns about using a generic industry label with others who may pack inferior quality. Therefore, we set out to determine how much consumers recall after having a bad experience with avocado fruit quality and if this concern is valid. 40% of consumers said they had been disappointed in the quality of an avocado they had recently purchased. Of these consumers, 57.73% could not recall the country of origin of this avocado and 91.7% could not recall the brand on the label. Over 46% of participants indicated that they waited over 2 weeks after a poor experience to re-purchase avocados. This clarifies this misconception and highlights the important role every supply chain member has in growing category demand for avocados. A bad experience for a consumer is a bad experience for the entire category, regardless of where that one piece of fruit came from.

So what does all this mean for Avocados Australia’s Industry Label?

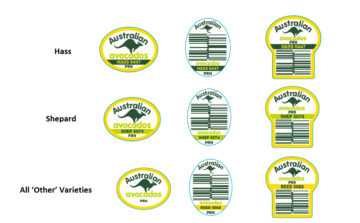

Based on the consumer research, Avocados Australia has reviewed the design elements of the industry label to ensure it continues to offer the maximum value to industry. The new design options are shown below:

Figure 11 – The new design options for the Avocados Australia Industry Label.

Figure 11 – The new design options for the Avocados Australia Industry Label.

What will stay the same?

- Size & Shape

The current design will be applied to the existing size and shape of the current label in market. Packers will not have to change the size of their existing label and therefore any application machinery if they do not wish to.

- The requirement for databars and PLU codes

Where data bars and PLU codes are required by retailers, this been accounted for in the new design. We have also kept colour variations to reflect different varieties as per the existing label but with less colours to minimise cost.

- Packhouse Registration Numbers (PRN)

A packhouse registration number is a unique code allocated to each Australian avocado packhouse by Avocados Australia. This is then provided to label suppliers who are licenced by Avocados Australia to print the label design. The license provides protection for the label design and the PRN provides fruit-level traceability.

What will change?

- Design Elements

Certain design elements such as the kangaroo symbol and “Australian Avocados” have been improved to be more prominent and to align with the branding of the $4m “Australian Avocados” marketing program. This has been achieved through changing colours, fonts and sizing of these elements so that the information consumers care about is most prominent. We have also reduced the number of colours on the new design to minimise costs to packers.

Next Steps

Currently Avocados Australia is working with the registered label suppliers to set up the new design ready for printing in the new year. Current users of the Avocado’s Australia label will be notified once the new design is available for printing. Current users will be able to use up all their existing labels before transferring across to the new design. If you have any questions or need assistance transferring to the new design please call Avocados Australia on (07) 3846 6566.

Frequently Asked Questions

Q. How do I transfer over to the new Avocado’s Australia Industry Label?

A. Transferring to the new Avocados Australia Industry Label is quick, cost-effective and easy! Contact us for more information(07) 3846 6566.

Q. Will I be able to use up all my existing labels before switching over to the new design?

A. Absolutely! You will be able to use up all your existing label stock on hand. However, when it’s time to print more labels you will be required to transfer over to the new design.

Q. What do I need to tell my printer if I want to use the new design?

A. All the registered printers are available on the Avocados Australia website. All you need to do is tell the printer that you would like to order the Avocados Australia Industry Label.

Q. Will the new design fit my existing applicator?

A. Yes, the size and shape of the labels has not changed. Packers will not have to change the size of their existing label and therefore any application machinery if they do not wish to.

This photo appears courtesy of QDAF.

This photo appears courtesy of QDAF.

Figure 1 – Labels included in the survey

Figure 1 – Labels included in the survey

Figure 3 – A word cloud diagram showing the words used by respondents to explain their label choices.

Figure 3 – A word cloud diagram showing the words used by respondents to explain their label choices. Figure 5 – A word cloud depicting what respondents were looking for on the avocado labels at retail.

Figure 5 – A word cloud depicting what respondents were looking for on the avocado labels at retail.

Figure 7 – Consumer path to purchase.

Figure 7 – Consumer path to purchase. Figure 8 – Images of Australian Avocados branding and marketing collateral.

Figure 8 – Images of Australian Avocados branding and marketing collateral. Figure 10 – On the left, an avocado with the Avocados Australia Industry Label. On the right, a word cloud depicting the words that respondents used to describe the label.

Figure 10 – On the left, an avocado with the Avocados Australia Industry Label. On the right, a word cloud depicting the words that respondents used to describe the label. Figure 11 – The new design options for the Avocados Australia Industry Label.

Figure 11 – The new design options for the Avocados Australia Industry Label.